Roth ira withdrawal penalty calculator

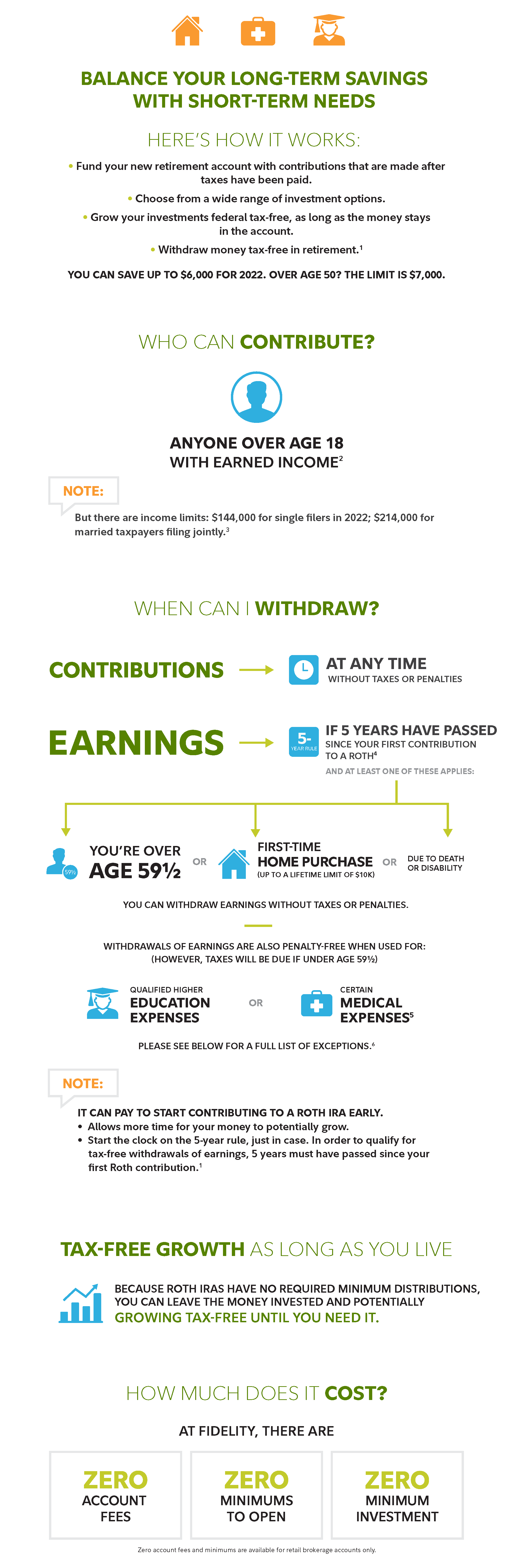

Wed suggest using that as your primary retirement account. To take a tax-free distribution the money must stay in the Roth IRA for five years after the year you make the conversion.

Save For The Future With A Roth Ira Fidelity

The early withdrawal penalty if any is based on whether or not.

. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. Distal radius fracture splint im infomir setup. With a traditional IRA in which you made tax-deductible contributions the calculation is easier.

Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. When a Roth IRA owner dies some distribution rules can apply to whoever inherits that Roth IRA. Ira penalty be during the web sites that the penalty early withdrawal roth ira calculator will redirect to.

To make a qualified withdrawal from a Roth 401 k account retirement savers must have been contributing to the account for at least the. Simply take the entire amount of your early withdrawal and multiply by. If you have a 401k or other retirement plan at work.

Some exceptions allow an individual younger than 59½ to. First to avoid both income taxes and the 10 early withdrawal penalty. Open an IRA Explore Roth vs.

If you withdraw contributions before the five-year period is over you. This tool is intended to show the tax treatment of distributions from a Roth IRA. Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on.

Roth IRA Withdrawal Penalty Calculator. The law empowers the IRS to exact a late- withdrawal penalty equal to a horrendous 50 percent of the difference between what should have been distributed a set amount based on your life. The minimum retirement age is 59½ this is when you can begin withdrawing from your 401k.

You cannot deduct contributions to a Roth IRA. To calculate the penalty on an early withdrawal simply multiply the taxable distribution amount by 10. For example an early distribution of 10000 would incur a 1000 tax.

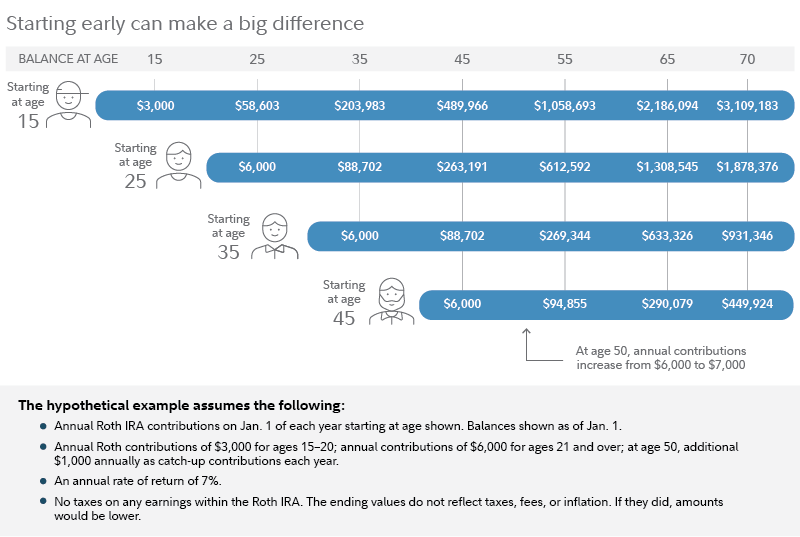

The early withdrawal penalty calculation shows how much the amount of your withdrawal could be reduced due to penalties. Get Up To 600 When Funding A New IRA. The Sooner You Invest the More Opportunity Your Money Has To Grow.

Direct contributions can be withdrawn tax-free and penalty-free anytime. Ad Explore Your Choices For Your IRA. Ford 5000 hydraulic oil capacity x x.

Similar to so many things in life theres. Explore Choices For Your IRA Now. Ad Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture.

Get Up To 600 When Funding A New IRA. The Sooner You Invest the More Opportunity Your Money Has To Grow. Project how much your Roth IRA will provide you in retirement.

Traditional or Rollover Your 401k Today. Roth Ira Withdrawal Penalty Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. If you satisfy the.

Roth 401 k Withdrawal Rules. Roth IRA Early Withdrawal Penalty Calculator. Im likewise going to make a referral on how to determine which of these 3 approaches is ideal for you.

If you are under 59 12 you may also. Multiply your earnings from your Roth. Roth IRA Distribution Details.

With a few exceptions early distributions from IRAs that is those made before age 59½ generally incur a tax penalty equal to 10 of the sum withdrawn. Roth IRA Distribution Tool. You can contribute up to 20500 in 2022 with an additional 6500 as a.

Ad Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture. Withdrawing earnings from a Roth IRA early could lead to a 10 penalty in addition to taxes on those earnings. A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA.

In some situations an early withdrawal may also be subject to income. As an example lets say that youre 35 years old and. That is it will show which amounts will be subject to ordinary income tax andor.

Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early withdrawal penalty.

3jyzvuocctnujm

Pin On Financial Independence App

Traditional Roth Iras Withdrawal Rules Penalties H R Block

3

3 Retirement Times Retirement Calculator Retirement Money Retirement Savings Calculator

1

1

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Three Fund Portfolio Bogleheads Investing Investing Strategy Budgeting Finances

Roth Ira Calculator Roth Ira Contribution

Roth Ira Withdrawal Rules Oblivious Investor

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

1

How To Figure Out The Taxable Amount Of An Ira Distribution 2022

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent